is car loan interest tax deductible in canada

Floor plan financing interest is not subject to the limitation that may reduce the interest expense deduction for automotive dealerships. If you are using a screen reader and having problems using our website please call1-800-718-5365 between the hours of.

Is Line Of Credit Interest Tax Deductible In Canada Ictsd Org

But writing off car loan interest as a business expense isnt as easy as just deciding you want to start itemizing your tax return when you file.

. A tax deduction may be claimed by taxpayers on the interest they pay on mortgages and loans. If you use your car for business purposes you may be able to deduct actual vehicle expenses. Interest you pay on money used to generate income may be deductible if it meets the Canada Revenue Agency criteria.

While loan interest not related to floor plan financing is still subject to the limitation imposed by the TCJA loan interest that results from floor plan financing is deductible without those limitations. The short answer is yes. In other words the lender must have the right to enforce payment of principal and interest on a loan.

Interest paid on a loan to purchase a car for personal use. If on the other hand the. In terms of primary residences you can deduct a portion of mortgage interest from the rental income you receive from a short- or long-term tenant in your home or from the business or professional.

You can typically deduct interest you have paid on business loans used solely for business purposes. Whether interest is deductible depends on how you use the money you borrow. Is car loan interest tax deductible in canada.

But you cant just subtract this interest from your earnings and pay tax on the remaining amount. Is mortgage interest tax-deductible in Canada. Unfortunately car loan interest isnt deductible for all taxpayers.

Should you use your car for work and youre an employee you cant write off any of. But there is one exception to this rule. To determine the amount of each actual vehicle expense that may qualify for a tax deduction you will need to calculate the percent of time that the vehicle is used for business.

However if you are buying a car for commercial use you can show the interest paid in a year as an expense and reduce your taxable income. It all depends on how the property is used. Thus you are not eligible for any deductions on your Car Loan if you are buying for your personal use.

Interest you paid on a loan used to buy the motor vehicle. Interest on a home equity line of credit HELOC or a home equity loan is tax deductible if you use the funds for renovations to your homethe phrase is buy build or substantially improve To be deductible the money must be spent on the property in which the equity is the source of the loan. Interest must be paid or payable.

Include the interest as an expense when you calculate your allowable motor vehicle expenses. The short answer is. You can deduct interest on the money you borrow to buy a motor vehicle zero-emission vehicle passenger vehicle or a zero-emission passenger vehicle you use to earn business professional farming or fishing income.

Is Interest On Bank Loan Tax Deductible. If the cash method ie an individual of reporting income is used the interest may be deducted in the year in which its paid. Include this interest as an expense when you calculate your allowable motor vehicle expenses.

Cheapest Electric Cars In Canada 2022 Loans Canada toys for christmas for 9 year olds. A personal loan a car loan or a credit card may not qualify for an interest deduction. 1 total annual interest paid or 2 1000 multiplied by the number of days you paid interest.

You must report your tax-deductible interest to the IRS and this invariably means filing additional. You can deduct interest on money you borrow to buy a motor vehicle zero-emission vehicle passenger vehicle or zero-emission passenger vehicle you use to earn business income. Credit card and installment interest incurred for personal expenses.

The tax deduction is only available for the interest component of the loan and not for the principal amount. Automobile loan interest Vehicle maintenance Insurance Tolls and parking fees Gasoline Oil Change. For interest to be deductible there must be a legal obligation to pay the interest.

The good news is that primary residences can qualify for. Is interest on a business loan tax deductible. You might pay at least one type of interest thats tax-deductible.

How does tax benefit on Car. When you use a passenger vehicle or a zero-emission passenger. Typically deducting car loan interest is not allowed.

This includes business loans that are guaranteed by insurance policies as long as the interest you paid is not added into the insurers base cost of the policy. You have to keep track of how you spend the money so you can deduct the corresponding interest amounts. Read on for details on how to deduct car loan interest on your tax return.

If you use your car for business purposes you may be allowed to partially deduct car loan interest as a business expense. Points if youre a seller service charges credit investigation fees and interest relating to tax-exempt income such as interest to purchase or carry tax-exempt. Mortgage interest is tax-deductible in Canada only when the property is used for the purposes of generating rental business or professional income.

The expense method or the standard mileage deduction when you file your taxes. If a business loan or charge for credit cards is used to finance your business expenses you may be able to claim interest on these charges once you file your taxes. Interest on loans is deductible under CRA-approved allowable motor vehicle expenses.

You can deduct the interest paid on an auto loan as a business expense using one of two methods. If you use a passenger vehicle or zero-emmission vehicle as defined by the CRA deduct the lesser of. Vehicle loans interest expenses.

This means that if you pay 1000 in interest on your car loan annually you can only claim a 500 deduction. Interest on car loans may be deductible if you use the car to help you earn income. Is Car Loan Interest Tax Deductible in Canada.

Car loan interest would be deductible if the vehicle was used for self employment or in the service of an employer but it is not deductible for personal use. There is no limit on what you can deduct for interest on capital investments according to Canada Revenue Agency CRA estimates but generally only if you use the money for investment purposes. Types of interest not deductible include personal interest such as.

For a mortgage to be tax-deductible in Canada the property the mortgage belongs to must be used for generating income whether thats rental income business or professional income. Tax-deductible interest is interest paid on loans that the IRS allows you to subtract from your taxable income.

Car Loan Calculator Estimate Your Car Payments

Is It Better To Lease Or Buy A Car For A Business In Canada

What Is The Total Cost Of Ownership For A Car Ratehub Ca

Taxation Of Shareholder Loans Canadian Tax Lawyer Analysis

How Can I Reduce My Taxes In Canada

Should I Buy Or Lease My New Business Vehicle 2022 Turbotax Canada Tips

Is It Better To Lease Or Buy A Car For A Business In Canada

What Is The Average Car Loan Interest Rate In Canada Loans Canada

Claiming Automotive Expense Reminders For Tax Season Owners Tips Autotrader Ca

![]()

Should You Get A 0 Car Loan Loans Canada

Car Loans Canada Review 2022 Greedyrates Ca

How To Qualify For A Car Loan Loans Canada

Is Car Loan Interest Tax Deductible In Canada

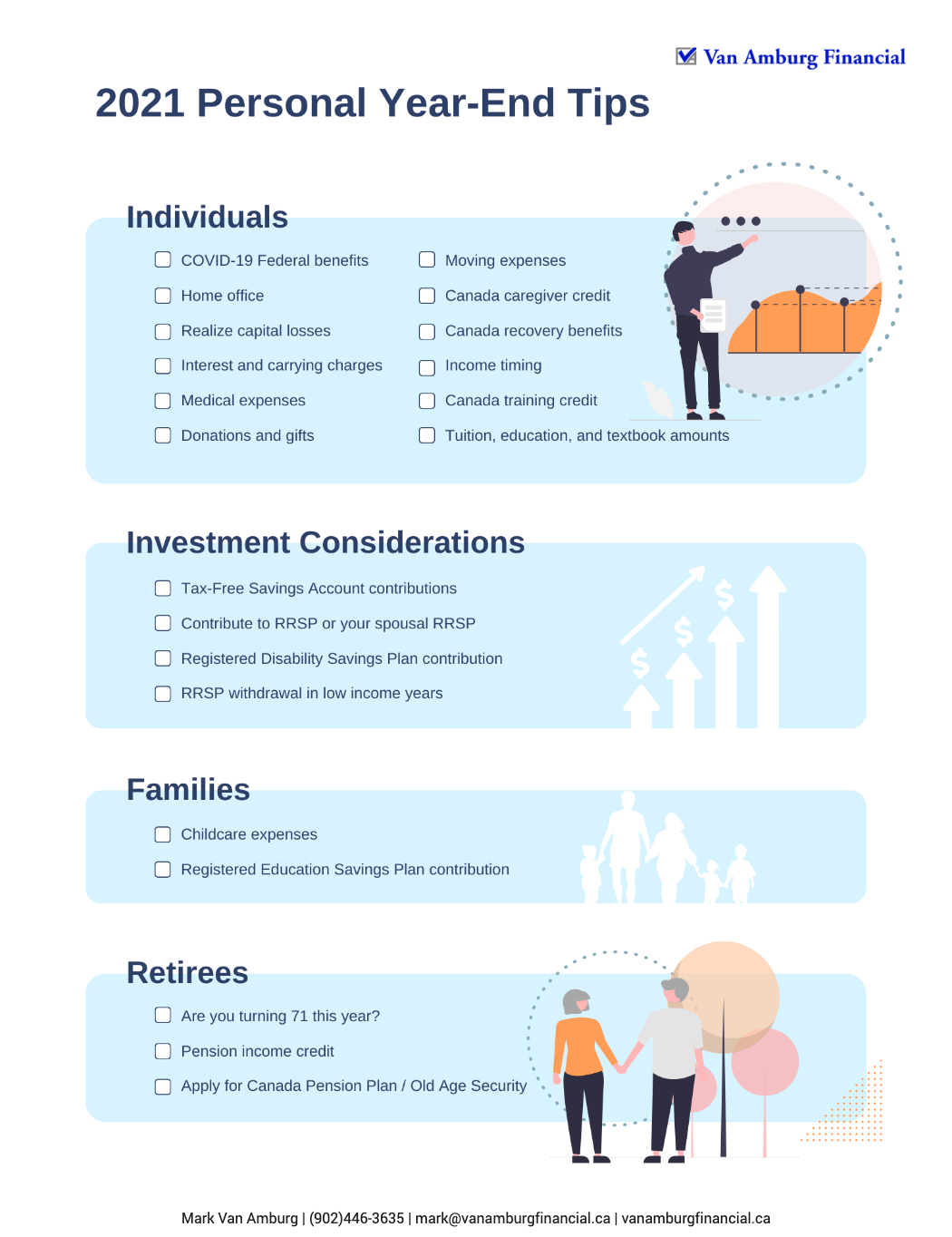

2021 Personal Year End Tax Tips Van Amburg Financial

Can I Claim Car Expenses On My Taxes Canada Ictsd Org

Car Loans Canada Review 2022 Greedyrates Ca

How To Make Canadian Interest Tax Deductible Dummies

How To Get A Car Loan In Canada With Bad Credit Greedyrates Ca