do you pay sales tax on a leased car in california

Of this 125 percent goes to the applicable county government. On the subsequent lease payments 2 or pay sales tax on the purchase of the motor vehicle and lease to consumers tax free.

California Vehicle Tax Everything You Need To Know

The state tax rate the local tax rate and any district tax rate that may be in effect.

. Unsure whether youll be taxed if you buy your leased car. For example imagine you are purchasing a vehicle for 20000 with the state sales tax of 725. The car buyer is responsible for paying VAT during a private car sale.

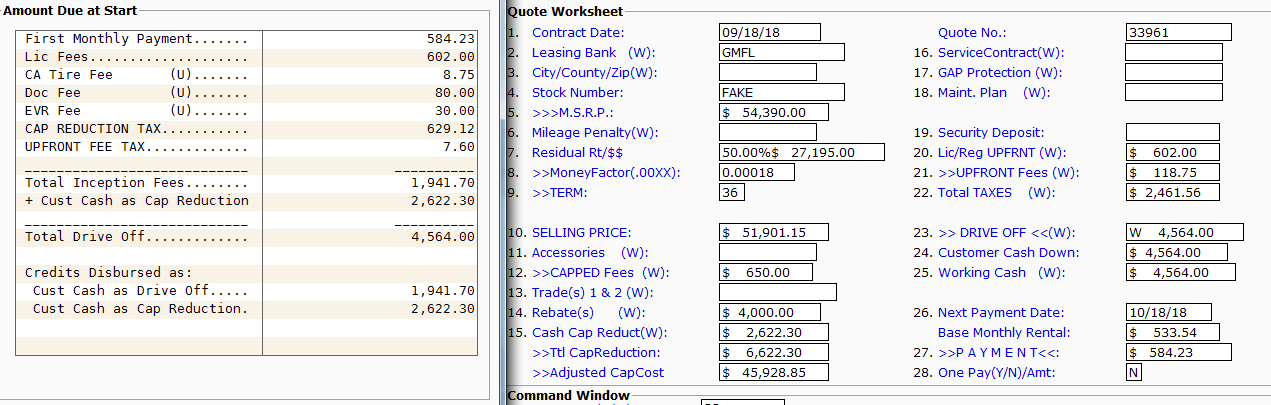

Gluck December 26 2018 1142pm 8. Love the car so far. The dealership is telling me that I will need to pay sales tax on the original price 22880 not the.

In some places youll have to pay sales or excise tax on the amount you put down plus your monthly payments. CA Rev Tax Code 6203 b 2017. The lessees signature alone will not be accepted for release of ownership.

20000 X 0725 1450. Depending on where you live leasing a car can trigger different tax consequences. Since the lease buyout is a purchase you must pay your states sales tax rate on the car.

Use tax is due. I emailed Tesla Financial about it and the response I received was that the sales tax is 925 to explain the total amount. A lease usually lasts from two to five years.

Sells the vehicle within 10 days use tax is due only from the third party. Buys the vehicle at the end of the lease use tax is based on the balance owed at the time of lease pay-off. Sales and Use Tax Law Chapter 35.

Local governments such as districts and cities can collect additional taxes on the sale of vehicles up to 25 in addition to the state tax. The 10 day window is the easiest way to execute the transaction with the DMV. Vehicles Vessels and Aircraft Article 1 Section 6277 6277Presumption on sale to lessee.

You just have to pay for licensing titling and registration. 1450 is how much you would need to pay in sales tax for the vehicle regardless of if it was used purchased with. When you lease you are only paying the vehicles depreciation during the lease term plus rent charges taxes and fees.

According to the Sales Tax Handbook the California sales tax for vehicles is 75 percent. If you buy a vehicle for 12000 and trade in your old vehicle for 6000 you will still have to pay taxes on the 12000 for which the car was originally sold. With some exceptions the lessor party who is loaning out the property must collect use tax from the lessee party obtaining the property at the time of the rental installment payment.

Like with any purchase the rules on when and how much sales tax youll pay. Leasing is a word that is used when one is renting something over an extended period of time. You pay sales tax monthly based on the amount of your payment.

You may not owe anything. The sales and use tax rate in a specific California location has three parts. If you buy your leased car at the end of your lease you may also be required to pay sales tax as part of the purchase.

There shall be a. State sales and use taxes provide revenue to the states General Fund to cities and counties through specific state fund allocations and to other local jurisdictions. When you purchase a car you pay sales tax on the total price of the vehicle.

Sales tax is a part of buying and leasing cars in states that charge it. In some states such as Oregon and New Hampshire theres no sales tax at all. Sells the vehicle after 10 days use.

The buyer must pay sales tax to the California Department of Motor Vehicles upon registration of the vehicle. Since the lease buyout is a purchase you must pay your states sales tax rate on the car. Answer 1 of 6.

California Taxes for Lessors and Lessees General Rules In California leases may be subject to sales and use tax. Multiply the vehicle price before trade-in or incentives by the sales tax fee. California collects a 75 state sales tax rate on the purchase of all vehicles of which 125 is allocated to county governments.

I know the pros cons of buying versus leasing which I dont want to discuss here. In a lease you do not own the vehicle. The California State Board of Equalization Board has promulgated Regulation 1660 which explains the law as it applies to leased property in general and transactions that may look like leases but are actually outright sales.

Here is the statue from California Board of Equalization. The minimum is 725. If the residual value is 20000 tax rate is 6 you will pay 1200 in sales tax.

Making the distinction between a true lease or sale at the outset is crucial because for sales the tax must be. If the transaction takes longer than ten days the seller documents the odometer reading at the beginning of the process the odometer at the actual sale with an. There is also a 50 dollar emissions testing fee which is applicable to.

You will not have to pay sales tax if you follow the section below. You rent it and can choose to buy it at the end of the lease. Remember automobile sales tax is collected by the DMV on behalf the tax authorities in California.

For example even though Delaware has no state sales tax it currently charges a document fee of 425 of the purchase price of a vehicle or the NADA book value whichever is more. Keep in mind sales tax is different from all the state fees you may have to pay to register title or inspect a vehicle you lease or buy. Payments for a lease are usually lower than payments for a purchase.

As of September 2011 Oregon Alaska New Hampshire Montana and Delaware do not assess a sales tax on consumers but if you live in one of these states you may be subject to. I just received my first monthly lease bill and it was a little higher than originally stated. I chose to lease a MY.

California Lease Tax Question Ask The Hackrs Forum Leasehackr

Kia Stinger Lease Payments Offers Riverside Ca

Mercedes Benz E Class Lease Deals Mercedes Benz Of San Diego Ca

Toyota Highlander Lease Deals San Diego Ca Kearny Mesa Toyota

Vw Taos Lease Deals Santa Ana Ca Volkswagen South Coast

Free California Standard Residential Lease Agreement Template Rental Agreement Templates Lease Agreement Free Printable Lease Agreement

Is Your Car Lease A Tax Write Off A Guide For Freelancers

Why Car Leasing Is Popular In California

Kia K5 Lease Payments Offers Riverside Ca

How To Lease A Car Credit Karma

Why Car Leasing Is Popular In California

Why Car Leasing Is Popular In California

Ford Mustang Mach E Lease Offers Orange County Ca

Honda Hr V Lease Deals San Jose Ca Capitol Honda

Why Car Leasing Is Popular In California

How To Buy Or Lease An Electric Car Advice From Owner Who S Done It Four Times

Registering An Out Of State Leased Vehicle In California When You Move Here By Bilal Zuberi Bz Notes Medium

Leasing Fees Explained In Detail Everything You Need To Know Capital Motor Cars

Subaru Crosstrek Lease Specials Santa Ana Ca Subaru Orange Coast